Legacy Gift – Stocks and Investment Accounts

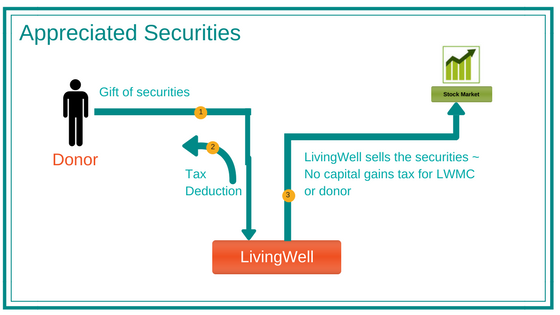

Giving appreciated stock to LivingWell Medical Clinic instead of cash can produce superior tax benefits. This gift enables many folks to give more than they otherwise could have by reducing their ordinary income taxes and avoiding capital gains taxes.

Giving stocks that have been held for more than one year directly to a ministry provides a significant opportunity to avoid capital gains tax, receive a deduction at the full-market value of the securities, and simplify your giving. Giving appreciated stock can be more beneficial than giving cash.

Contact your broker about a TOD (Transfer on Death) form to designate and donate a single stock certificate. Contact your broker or investment account holder about a beneficiary designation form (or TOD form) for mutual funds or other types of investment accounts.

Benefits:

- You receive an income tax deduction for the fair market value of the securities on the date of transfer, no matter what you originally paid for them.

- You pay no capital gains tax on the transfer when the stock or share of investment account is sold.

Planning for Your Future

Investment accounts hold cash or stocks for the long term. The objective of investment and mutual fund accounts is to achieve long-term growth, provide future income or preserve capital. The remaining account balance may be transferred to heirs or charity after your passing.

When you opened the account, you should have received a form that tells the financial institution what to do with the assets when you pass away. This form is called a “Transfer on Death” (TOD) form. With it, you decide how your assets will be transferred. If you do not complete this form, you will cause unnecessary confusion among your heirs and added expense to your estate administration.

Ask your account custodian for a TOD form, complete it, and share it with your financial or legal advisor. You can also leave all or a percentage of the assets to LivingWell Medical Clinic. Any portion of your investment account left to LivingWell Medical Clinic will be exempt from estate and inheritance tax. You also avoid paying any capital gains on assets that have increase in value over the years.

The material presented on this Legacy Giving website is not offered as legal or tax advice. Read full disclaimer